Starting in the spring of 2005

Starting in the spring of 2005, these adjustable rate mortgages began to get a lot more popular, largely because regular mortgages no longer allowed many buyers to afford the house they wanted.

They turned instead to a mortgage that had an artificially low interest rate for an initial period, before resetting to a higher rate. When the higher rate kicks in, the monthly mortgage bill typically jumps by hundreds of dollars. The initial period often lasted two years, and two plus 2005 equals right about now.

The peak month for the resetting of mortgages will come this October, according to Credit Suisse, when more than $50 billion in mortgages will switch to a new rate for the first time. The level

will remain above $30 billion a month through September 2008. In all, the interest rates on about $1 trillion worth of mortgages, or 12 percent of the nation’s total, will reset for the first time this year or next. A couple of years ago, by comparison, only a marginal amount of mortgage debt — a few billion dollars — was resetting each month.

So all the carnage in the mortgage market thus far has come even before the bulk of mortgages have reset. “The worst is not over in the subprime mortgage market,” analysts at JPMorgan recently wrote to the firm’s clients. “The reason for our pessimism is that loans originated in late 2005 and all of 2006, the period that saw peak origination volumes and sharply decreased underwriting quality, are only now starting to reset in large numbers.”

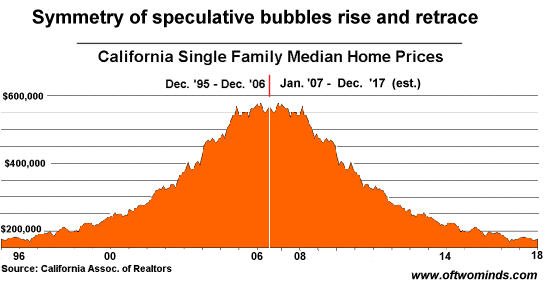

The flood of those homes onto the market will further depress house prices. So will the newfound conservatism of mortgage lenders, which will make it harder for tomorrow’s buyers to get a mortgage. (Thank goodness.) The S.& P./Case-Shiller index of home prices covering 10 major cities has fallen about 3 percent since its peak last summer. Two or three years from now, JPMorgan predicts, the index will have fallen 15 to 20 percent. Adjusting for inflation, the decline will be worse.

There has never been a real estate bubble like the one of the last decade. So it’s impossible to know what the bust will bring, especially when there are still so many mortgages that are about to get a lot more expensive.

From: patrict.net via NY Times Aug. 3rd