Housing stages: 15 years from now

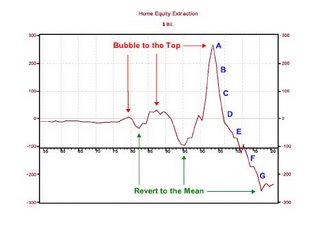

Step A: You are here. Whether the rate of home equity extraction implodes from here (as shown) or decreases more gradually is a matter of debate, although in past boom-bust cycles, the bust rate of decline has been significantly more rapid than the boom rate of growth. What is not debatable is whether the rate of home equity extraction will revert to the mean rate of about zero, from the current rate of more than $250 billion annually. It will.

In fact, the rate of home equity extraction will tend to overshoot the mean to reach an extreme negative rate of equity extraction (building equity) that's twice the rate of positive extraction that occurred during the boom phase. This relationship occurred in the previous two cycles, which bottomed in 1982 and 1995, respectively. This implies negative equity extraction of minus $500 billion per year at the cycle trough. Chart 2 shows a more optimistic prediction of negative $250 billion occurring between 2015 and 2020. This more prosaic estimate accounts for government efforts to mitigate the impact and minimize the overshoot, by offering specialized loans, making direct purchases of securitized mortgage debt, and so on.

Step B: As housing prices begin to decline, sales will continue, though more slowly and less frequently. Old habits die slowly. One year into the decline, housing speculators will have left the market, but home owners will generally still believe that prices will either resume their rise or at least flatten out, not continue to decline. Remember the first year of the stock market bubble decline, when most people hung in there until they'd lost all of their money? The first lesson of behavioral finance is that the most common mistake made by market participants is to hang on too long and fail to cut losses.

While home owners at this stage will borrow less against their houses, and loans will be more difficult to come by, the average home owner will still make frequent trips to Home Depot or hire contractors to make home repairs and improvements, believing they'll "get their money back" in an increase in the value of their home at least equal to the cost of fixing it. Some home owners will put their home up for sale—if they purchased early enough in the boom so that they can still realize a profit, even selling at five to twenty percent below the peak price.

Step C: After prices have declined for two years, large numbers of buyers who purchased near the top of the market will begin to feel the psychological effects of being underwater on their mortgage. They will be less inclined to borrow money, or to spend money fixing up their home, as home improvement value increases will be swallowed up by general market price declines. There will still be profits to be made by those who bought very early in the previous boom cycle, but fewer people will have this option.

As transaction volumes continue to fall, demand for housing-related employment will decline too. The first signs of labor market distress will start to show up, as more and more of that 43% of the private sector who found jobs in the housing industry are no longer needed. Coincidentally, major employers—such as the U.S. auto industry—will be going through major restructuring, adding to pressures on housing prices in some areas. Some home owners will need to sell at a loss in order to move to regions of the country where the labor picture is better, and will do this if they have enough equity and are not paying cash out of pocket to cover their remaining mortgage obligations. These sales will further depress home prices.

Step D: Three years into the decline, marginal home buyers will learn what owning a home really costs, versus renting when housing prices are declining and jobs are more scarce. Rent is a fixed cost, whereas home ownership presents many variable costs, including increased interest payments on ARMs, and rising tax, insurance, and energy costs. Also, upkeep for the average home typically costs five to ten percent of the price of the home, annually. As prices fall, homeowners will have less access to home equity loans. Many will not be able to afford repair and maintenance expenses. Homes in some neighborhoods—and in some cases, entire neighborhoods—will begin to look neglected, further depressing prices.

Step E: Five years into the downturn, rising unemployment will begin to more seriously affect the market, as indicated in Chart 1. As unemployment rises, homeowners will leave housing bust regions to move to areas where there are more jobs. Many houses will be sold at a loss, or even abandoned, as the market price falls below the loan value. Given the choice between paying cash out of pocket to sell their home or leaving the keys with the bank, many home owners will make the latter choice.

Step F: Ten years into the downturn, real estate will be widely regarded as a terrible, "can't win" investment. McMansions will be subdivided for rental as multi-family homes.

Step G: Ten to fifteen years after the start of the decline in housing values, prices will bottom out, setting the stage for the next boom. Time to buy.

0 Comments:

Post a Comment

<< Home